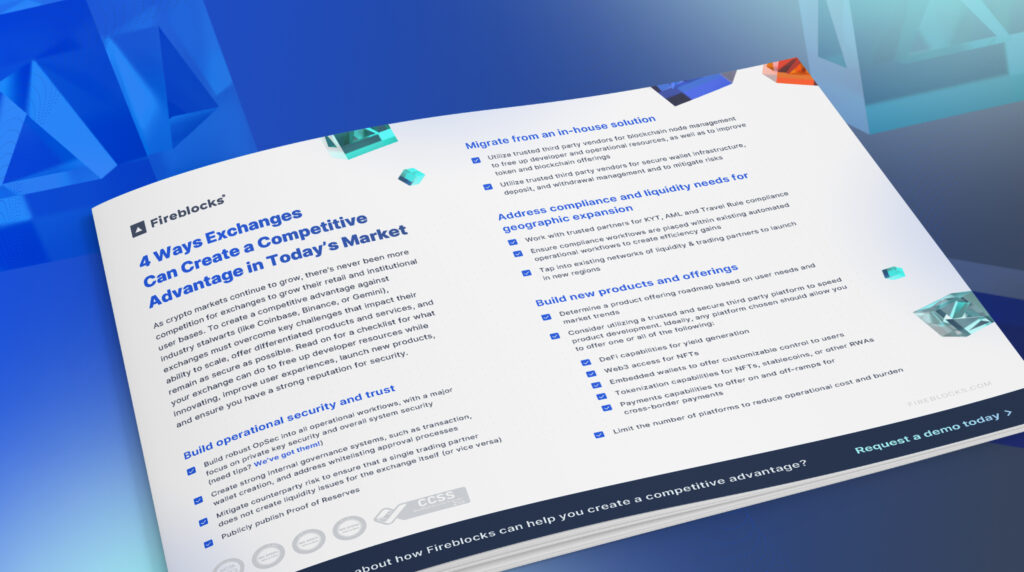

As crypto markets continue to grow, there’s never been more competition for exchanges to grow their retail and institutional user bases. To create a competitive advantage against industry stalwarts (like Coinbase, Binance, or Gemini), exchanges must overcome key challenges that impact their ability to scale, offer differentiated products and services, and remain as secure as possible. Read on for a checklist for what your exchange can do to free up developer resources while innovating, improve user experiences, launch new products, and ensure you have a strong reputation for security.

Build operational security and trust

- Build robust OpSec into all operational workflows, with a major focus on private key security and overall system security (need tips? We’ve got them!)

- Create strong internal governance systems, such as transaction, wallet creation, and address whitelisting approval processes

- Mitigate counterparty risk to ensure that a single trading partner does not create liquidity issues for the exchange itself (or vice versa)

- Publicly publish Proof of Reserves

Migrate from an in-house solution

- Utilize trusted third party vendors for blockchain node management to free up developer and operational resources, as well as to improve token and blockchain offerings

- Utilize trusted third party vendors for secure wallet infrastructure, deposit, and withdrawal management and to mitigate risks

Address compliance and liquidity needs for geographic expansion

- Work with trusted partners for KYT, AML and Travel Rule compliance

- Ensure compliance workflows are placed within existing automated operational workflows to create efficiency gains

- Tap into existing networks of liquidity & trading partners to launch in new regions

Build new products and offerings

- Determine a product offering roadmap based on user needs and market trends

- Consider utilizing a trusted and secure third party platform to speed product development. Ideally, any platform chosen should allow you to offer one or all of the following:

- DeFi capabilities for yield generation

- Web3 access for NFTs

- Embedded wallets to offer customizable control to users

- Tokenization capabilities for NFTs, stablecoins, or other RWAs

- Payments capabilities to offer on and off-ramps for cross-border payments

- Limit the number of platforms to reduce operational cost and burden