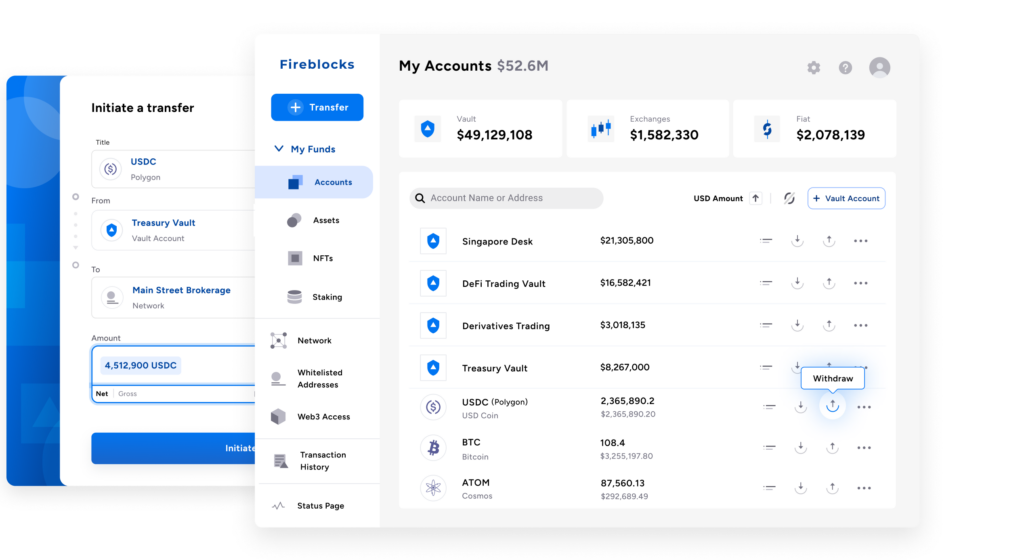

Today, Fireblocks is launching Off Exchange – a new solution that enables trading firms and asset managers to trade on centralized exchanges from an on-chain MPC shared wallet, eliminating exchange counterparty risks.

Fireblocks Off Exchange leverages MPC technology to enable traders to allocate and mirror assets directly to an exchange from a wallet they mutually control, protecting their principal from hacks, bankruptcy, and fraud, while providing centralized exchanges with complete on-chain transparency that client accounts are fully collateralized.

Off Exchange is launching with support for Deribit, with HTX, ByBit, OKX, Gate.io, BIT, OneTrading, Coinhako, Bitget, and additional global exchanges being added in the coming months.

Understanding exchange counterparty risk

Exchange counterparty risk takes various forms, including cyber hacks, bankruptcy, commingled accounts, and misappropriation of client funds, as evidenced by the FTX incident. These risks stem from the unique structure of the crypto trading market, where exchanges play the role of both a custodian and trading venue. The outsized counterparty risks have restricted the capital that trading firms deploy on exchanges, and prevented traditional firms from entering the crypto market altogether.

To counter this risk, operations teams have traditionally implemented time-consuming processes to monitor exposure and constantly sweep excess exchange margins to protect their businesses. But these processes only manage exposure, as they cannot fully mitigate the risk that their funds are commingled at an exchange. This trading model is also adverse to exchanges, as institutions reduce capital to maintain risk limits.

Delivering the first true Off Exchange solution

Existing off-exchange solutions attempt to solve exchange counterparty risk by pooling traders assets in a custodial account, which are then mirrored to an exchange account where they’re made available for trading. But, this custodial approach transfers the counterparty risk from the exchange to a centralized clearing party.

Fireblocks Off Exchange takes a technology-first approach, enabling traders to eliminate all forms of exchange counterparty risk by programmatically locking funds in secure MPC-based shared wallets.

Unlike custodial solutions that transfer counterparty risk to centralized clearing parties, Fireblocks Off Exchange takes a technology-first approach, enabling traders to eliminate all forms of exchange counterparty risk by programmatically locking funds in secure MPC-based shared wallets.

With Fireblocks Off Exchange, traders and exchanges can settle trades in real-time and move capital between venues and counterparties, allowing them to quickly capitalize on new trading opportunities.

Restoring risk balance in the trading market

The collapse of FTX not only directly affected exchange clients but also had a widespread impact on exchanges globally, eroding trust in any third-party custodian. Given these events – alongside a prolonged crypto bear market – exchanges are looking for new ways to increase the capital institutional traders deploy on their venues.

Off Exchange enables exchanges to drive institutional volumes by providing a new solution, significantly reducing the counterparty risk associated with crypto exchange trading.

Fireblocks Off Exchange delivers the first blockchain-native solution, providing exchanges with complete transparency to monitor and validate client collateral on-chain and enforce risk management without taking custody. This increases liquidity for exchanges and traders by eliminating the need for both parties to lock funds in a third-party cold storage solution. It also empowers exchanges and traders to mitigate adverse impact on funds while maximizing their capital efficiency.

Unlike custodial solutions that require exchanges to pledge assets, Off Exchange does not require exchanges to lock their assets, allowing them to remain liquid without taking direct counterparty risk to Fireblocks.

By integrating with the Fireblocks Network, exchanges can instantly reach thousands of the largest institutional traders and provide them with an Off Exchange solution directly from their existing workflow.

Our continual commitment to solving counterparty risk

Fireblocks has a long-standing commitment to building products that mitigate counterparty risk.

When Fireblocks launched in 2018, we developed the Direct Custody model, which enables businesses to remain in complete control of their private keys while uniquely providing the highest security and operational efficiency. This model fundamentally shifted the risk profile businesses experienced when selecting a custodial technology and set a new standard in the digital asset space.

The Fireblocks Network has also been central to mitigating counterparty risk for institutional traders by eliminating the risks associated with deposit addresses. Businesses on the Fireblocks Network can directly connect via their Network profiles and don’t have to worry about the possibility of asset loss due to a deposit address attack or human error.

Recently, Fireblocks also launched Non-Custodial Wallets-as-a-Service, enabling retail businesses to embed MPC wallets into their application and provide their end-users full control of their keys.

With the launch of Off Exchange, Fireblocks is furthering its commitment to building solutions that truly eliminate counterparty risk in the digital asset ecosystem. Our vision for Off Exchange extends beyond decoupling custody from trading for crypto exchanges. As Fireblocks actively engages with the leading sell-side firms and traditional trading venues, the Off Exchange model represents a significant step forward in building the next generation of digital financial markets.

Get a personalized demo

See how Fireblocks helps your digital asset business to grow fast and stay secure