1 min. read

How Bancolombia Group Brought Digital Assets to Retail Customers with Fireblocks

Benefits at a glance

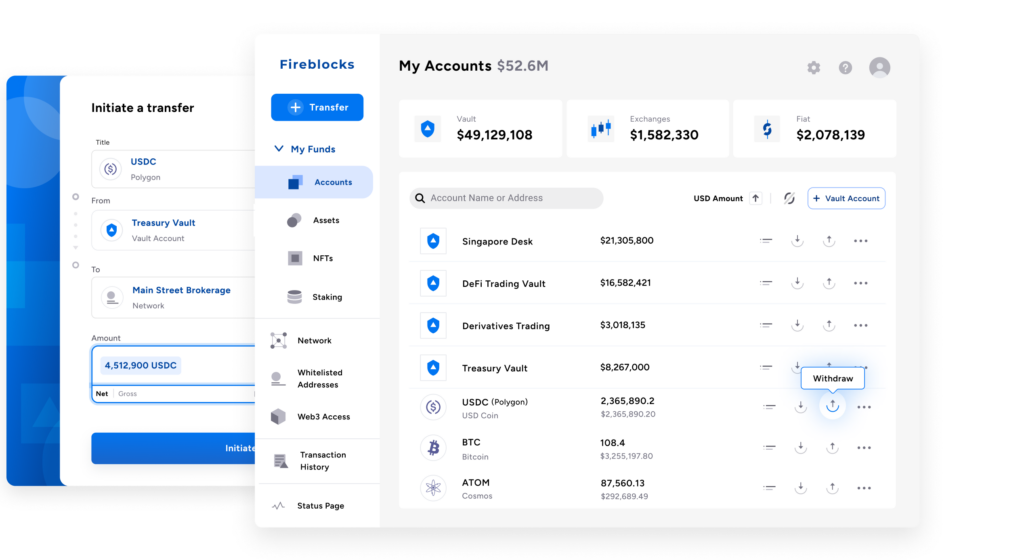

Secure and Efficient Treasury Management

Used Fireblocks to ensure high security and regulatory compliance for Bancolombia's digital asset operations

In May this year, Bancolombia Group, one of the largest financial groups in Colombia and Central America, announced the launch of Wenia, a full-service digital asset offering to its retail customer base which is powered by Fireblocks. Through Wenia, Bancolombia Group is one of the first major financial institutions to launch a digital asset service to retail customers. With a goal of onboarding 60,000 users by the end of 2024, Wenia will start by offering digital asset trading & custody for $BTC, $ETH, $MATIC and $USDC on Polygon, as well as issuing a Colombian peso-backed stablecoin on Polygon called $COPW.

$COPW is still in its early stages but currently, Wenia customers have ability to seamlessly on- and off-ramp from fiat into crypto assets within the Bancolombia Group ecosystem.

We have been working for almost a decade on the opportunity to create solutions that facilitate the adoption and use of digital assets and blockchain technology. As a result, we responded quickly to the adoption of Bitcoin in El Salvador. We are proud to deliver this new company to the country, with which we are committed to driving technology towards a more dynamic future and available to everyone. With Wenia we are strengthening financial inclusion while contributing to the continuous development of the country’s digital economy.

Juan Carlos Mora

President, Grupo Bancolombia

Launching a crypto service in Colombia

The financial services environment is changing rapidly in Colombia, along with the broader Latin America. Colombia is ranked 10th globally for most crypto transactions and ranked 4th in Latin America for adoption of crypto, according to Chainalysis.

As a result of these market dynamics, Bancolombia Group saw strong demand and appetite for digital assets amongst its customer base. That’s why they launched Wenia to provide regulated infrastructure for users to interact and transact in a safe and secure manner.

At Wenia, security and regulatory compliance are our top priorities when managing digital assets. We chose to partner with Fireblocks due to their advanced multi-party computation (MPC) wallet, robust policy engine, and comprehensive compliance toolkit, which ensures the highest level of security and adherence to regulations for both our assets and our clients’ assets. In addition to custodying digital assets, we leverage Fireblocks’ tokenization platform and vault structures to manage the lifecycle of our stablecoin, $COPW. Fireblocks’ technology allows us to efficiently and securely manage digital assets, enhancing operational efficiency and client satisfaction.

Pablo Arboleda

CEO, Wenia

How Wenia leverages Fireblocks

Wenia used Fireblocks’ full suite of capabilities to launch and scale their digital asset offering, including their Colombian Peso-backed stablecoin, $COPW. Key Fireblocks features that Wenia uses:

- Policy Engine for secure and efficient treasury management

- Direct Custody Wallets-as-a-Service for secure retail user wallets

- Tokenization Engine to tokenize and manage the token lifecycle operations for $COPW

- Compliance Suite for KYT/AML (Chainalysis) and Travel Rule Compliance (Notabene)

Through Wenia, Bancolombia Group is creating an important bridge between TradFi and digital assets for their customers. Latin America continues to be one of the most forward-thinking geographic regions in the digital asset space. This is the first real example of how financial institutions can execute on a retail-facing digital asset strategy in a secure, efficient and compliant manner. Bancolombia Group is one of the first movers in LatAm; we think that this can be replicated globally as we see regulatory frameworks evolve for tokenized money.

Michael Shaulov

Co-Founder and CEO, Fireblocks

Get a personalized demo

See how Fireblocks helps your digital asset business to grow fast and stay secure