1 min. read

How Revolut eliminated closed-loop custody and manual treasury operations to scale their finance platform with Fireblocks

Benefits at a glance

Automated security and granular governance

Accelerated launching of new features like “Crypto Withdrawal”

Faster integration of new tokens and liquidity providers

Revolut is a full-stack financial platform that gives users a fair, frictionless way to interact with their money. You can trade stocks, commodities, and crypto from the palm of your hand, and enjoy the benefits of 30 currencies out of the box. According to Edward Cooper, Head of Cryptocurrency at Revolut, “we’re aiming to be the number one go-to super app of finance.”

The process of logging into different providers to do rebalancing used to be extremely cumbersome. I think that if we hadn’t onboarded a partner like Fireblocks, we would have struggled to keep up with increased volume during the bull run.

Challenges

Too many crypto operations require manual intervention

Revolut couldn’t scale at the pace they wanted — their infrastructure for crypto and internal crypto treasury movements involved a fair amount of manual work.

To cover security needs, multiple people had to log into different providers to do rebalancing: one security- cleared team member with access to passwords stored in a password manager, another with a two-factor authentication device which rotated between a number of authorised personnel, and another team member to oversee everything.

If there was a bull run, the Revolut team knew their manual processes would slow them down. Revolut needed a way to offer flawless execution in their treasury operations.

Revolut’s existing crypto infrastructure was limiting their ability to grow the business and roll out products that would allow them to differentiate fast enough. Launching a customer withdrawal feature was especially critical in their plan to offer the full suite of crypto products their customers want.

To get closer to their goal of becoming the “go-to super app,” Revolut needed to get rid of barriers to scaling: the closed-loop crypto model and manual internal treasury movements that prevented them from quickly rolling out features to new users.

Overall, they needed a flexible crypto infrastructure, powerful security features, a powerful API for the dizzying amount of available integrations, and automation to free up their team.

To protect assets from outsider hacks and insider threats while they’re being stored and transferred, Revolut knew they needed to choose a provider with MPC-CMP cryptography. MPC simplifies private key management, and would give Revolut the peace of mind that their digital assets are protected both from cyber attacks, internal collusion, and human error.

Now, it’s very simple. People can just request to transfer funds. If they go over certain thresholds or hit certain triggers, other people in the organization will be pinged to approve it. The automation removed a lot of the pain that we were having.

Get a personalized demo

See how Fireblocks helps your digital asset business to grow fast and stay secure

Solution

One integration to streamline scaling

Revolut considered five finalists in their search for a technology provider. They ultimately chose Fireblocks based on the Fireblocks Network, MPC-CMP technology, powerful API, and simple UI.

Fireblocks provided a wallet management solution that could support Revolut’s retail customer base.

Edward knew that the “Facebook effect” meant the Fireblocks Network would be incredibly valuable for Revolut — the more people on a network, the more valuable it becomes. The Fireblocks Network is the first and only institutional digital asset transfer network, which makes it simple for Revolut to integrate with new tokens or liquidity providers.

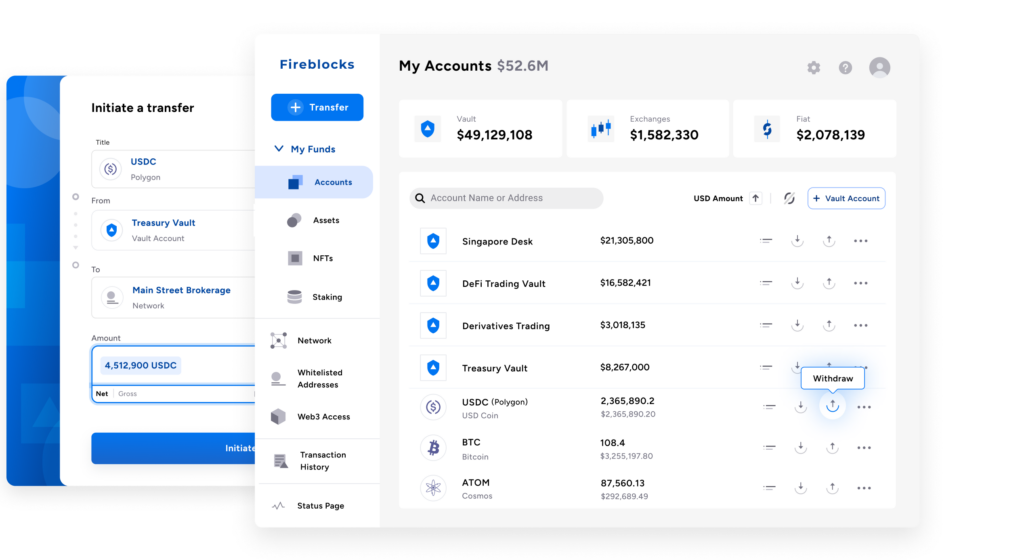

With the granular governance layer built into Fireblocks, Revolut could replicate their organizational structure directly onto the software with customized access levels. Instead of needing a second set of eyes on every transaction, the software will block transactions over a certain threshold. Revolut defined rules so that if the transfer amount goes over a threshold or hits a predefined trigger, a specific person is notified to approve a transaction.

Results

Less time on rebalancing and integrations means more time launching features

The granular security and governance layer built into Fireblocks eliminated the need for multiple eyes on each level of the rebalancing process. With security handled and rebalancing automated, team members were freed up to move the platform forward. Fireblocks’ simple UI also allowed team members who aren’t necessarily crypto experts to perform complex crypto transactions without needing to know the complicated details.

Now, Revolut is able to roll out advanced crypto features faster. Revolut just needs to do one integration via the API and they’re able to keep pace with the industry, since Fireblocks constantly updates their software for new initiatives and exposes the API. For example, Revolut needed a specific technical infrastructure to offer their upcoming “Crypto Withdrawals” feature (releasing soon!) in a safe, scalable way. Revolut could leverage the Fireblocks API to power this new withdrawal feature.

Before Fireblocks, onboarding a new crypto partner or liquidity providers meant manual headaches for the Revolut team. Joining the Fireblocks Network and streamlining the onboarding process means that integrating with new crypto partners, liquidity providers, or adding new tokens happens much faster.

This means Revolut can scale faster, roll out the features their customers have been asking for, and capture even more of the financial market.

Before, if we wanted to add new liquidity providers or tokens, that involved multiple different integrations during onboarding. But because of the Fireblocks Network, the integration is essentially already done because we’ve integrated with Fireblocks. So we just use Fireblocks’ UI to plug them in. Fireblocks has done all the heavy lifting.