Liquid markets have been essential for the expansion, growth and adoption of financial products, and over the past 30 years we have seen financial markets grow exponentially. Innovation has removed friction and created pathways to previously illiquid markets driving increases in the breadth and depth of these markets. In our view, two of the key drivers have been:

- Digitization of Markets: the evolution of digitization and electronic trading has helped fuel liquidity and access by opening the markets to a larger base of investors. Reduced transaction costs have in turn driven down average trans action sizes and increased the number of transactions and volumes, which results in higher velocity and stabilized markets.

- Securitization of Products: the securitization of illiquid assets has enabled in vectors to diversify their portfolios while providing issuers access to additional liquidity which in turn has increased the overall size of financial markets.

Among all the new and emerging technologies changing the way markets operate and how market participants interact, blockchain technology has the potential to have the most impact. While digital-native assets such as Bitcoin and Ethereum have garnered the most attention in the past few years, the concept of tokenization – or managing traditional assets through wallet and blockchain infrastructure – will promote growth and inclusion in financial markets more broadly. Migrating tradi tional assets to blockchain and wallet infrastructure will allow market participants to experience the key benefits of this emerging technology, including increased transaction security, speed, and transparency, as well as reduced settlement costs.

Tokenization and blockchain technology will bring efficiencies to traditional custody and settlement models by allowing market participants to interact directly in a trustless environment, removing intermediaries and ultimately increasing the efficiencies for traditional markets, while providing greater access to investors for otherwise illiquid assets. We have already seen advancements in tokenization use cases in the commodities, debt securities, equity securities, and real estate markets. As the tokenized asset market expands, it will enable these assets to be used in new ways, such as serving as collateral within the direct lending and decentralized finance (DeFi) markets.

In this paper, we explore the potential impacts of tokenization on traditional markets, existing tokenization use cases across various markets today, and the key considerations for financial institutions to strategically position themselves to take advantage of this technology that is at the initial stages of becoming foundational to digital financial markets.

Digitization, Securitization and Blockchains Sets the Scene for Tokenization

Digitization of Markets

Through the evolution of digitization and electronic trading of the equities market, there was a movement away from fractional quotes to decimals (or decimalisation), which came into effect in August 2000 after the Common Cents Stock Pricing Act was signed in 1997. This helped fuel liquidity and access by opening the markets to a larger base of investors through reduced transaction costs and which in turn drove down average transaction sizes, increasing the number of transactions and volumes resulting in higher velocity and stable markets.

Below we can see the increase in U.S. household participation in equities markets through this period of digitization. Tokenization could have a similar effect going forward of increasing participation via opening access to new markets, reduced transaction size requirements and lower transaction costs.

Exhibit 1. Market Participation Evolution

| Threshold signatures | Acceleration in Participation | Participation Pre-Decimalisation | Participation Pre-Tokenization | Participation Tokenization |

|---|---|---|---|---|

| 1952 >> | 1989 >> | 1998 >> | 2020 >> | 2030 >> |

| 6% | 32% | 48% | 53% | 53% <? |

Source: U.S. Federal Reserve Survey of Consumer Finances

While the digitization of trading enabled great access to markets, the underlying custody and settlement did not evolve as quickly. This is where we see significant opportunities for tokenization to impact markets by providing direct custody and settlement between market participants, and providing more flexibility for these participants to manage assets within their portfolio.

Securitization of Products

Securitization began with the pooling of home mortgages in the U.S., and since the 1980s has expanded into other income-producing assets. Financial institutions have found the benefits of securitization to include the transfer of credit risk from their balance sheet to other financial institutions looking for interest-bearing securities to suit their risk appetite. Financial institutions have experienced the benefit of increased liquidity by making less accessible and illiquid assets more accessible and liquid.

Rating systems measured credit risk and were assigned to securitized assets to differentiate the risk each individual or groups of assets posed. This allowed for the monitoring of changes and trends in risk levels, and enabled the management of risk to optimize returns. However, during the subprime crisis that emerged in 2007-2008, weaknesses in the securitization process which resulted from a lack of transparency become more apparent – such as poor credit origination, low lending standards, and insufficient regulatory oversight, which undermined the global financial system. Subsequently, stricter rules and processes were implemented by regulators and financial institutions, allowing securitization to resume and grow; in the last five years, global structured finance new issue volumes grew from $700 billion in 2015 to $1,070 billion in 2020. While growth in this segment has occurred, the underlying issue around securitized asset transparency in baskets of assets still remains.We see tokenization as the next step in this evolution as it allows for full transparency and visibility into each asset within the basket.

Exhibit 2. Global Structured Finance New Issue Volumes

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021F | |

|---|---|---|---|---|---|---|---|

| U.S. (bil. US$) | 436 | 373 | 510 | 540 | 582 | 452 | 520 |

| Canada (bil. US$) | 15 | 18 | 20 | 25 | 19 | 11 | 21 |

| Europe (bil. €) | 78 | 81 | 82 | 107 | 102 | 68 | 75 |

| Asia-Pacifi (bil. US$) | |||||||

| China | 97 | 116 | 220 | 292 | 334 | 432 | 500 |

| Japan | 38 | 53 | 48 | 56 | 61 | 60 | 60 |

| Australia | 24 | 16 | 36 | 23 | 31 | 22 | 22 |

| Total APAC | 159 | 185 | 305 | 371 | 420 | 514 | 582 |

| Latin America (bil. US$) | 11 | 12 | 17 | 9 | 13 | 13 | 15 |

| Approximate global new issue total (bil. US$) | 700 | 670 | 930 | 1,050 | 1,150 | 1,070 | 1,225 |

Source: S&P Global Rating

Digital-Native Token Blockchains

Digital-native tokens issued on blockchains such as Bitcoin allow for value to be transferred directly between two parties, removing the need for an intermediary and leveraging the blockchain as the single source of truth. Using blockchain and wallet technology enables an investor to prove full legal ownership of the underlying asset. Today, the primary assets in the digital asset market are digital-native, which has seen exponential growth in user adoption and market value in both centralized and decentralized venues. Bitcoin has increased 113% in market capitalization to $1,071 billion in November 2021 with average daily volumes (7 days) of $25 billion compared to $504 billion in December 2020 with average daily volumes of $8 billion. Digitalnative assets have paved the way for traditional asset transformation to digital f inancial markets based on blockchain technologies.

Tokenization of Traditional Assets

Tokenization combines all the elements outlined previously from digitization, securitization and digital-native asset blockchains and applies it to traditional assets creating a digital representation which can be stored, transferred, and settled over the blockchain. Tokenized asset are governed by a smart contract, which is the code stored on a blockchain that runs once predetermined conditions are met. Tokenization enables traditional assets to experience the benefits of transactional transparency, security, speed, traceability and reduced costs. There have been several tokenization use cases we have seen in the market to date, including:

| Asset Class | Issuer | Use Case | Impact | % Growth (Jan-Aug 2021 Market Cap) |

|---|---|---|---|---|

| Gold | Paxos | Tokenization of gold backed 11 with gold reserves to enable retail investors to purchase | Remove custody fees, decrease the minimum purchase amount combined with instant settlement of tokens to investors. | 340% |

| Equity Securities | Overstock.com | Tokenization of shares for annual dividend | List various classes of shares allowing issuers to take advantage of overall lower transaction costs, liquidity, security, and corporate action efficiencies of programmable smart contracts. | 35% |

| Debt Securities | Multiple (DBS, EIB, SocGen) | Tokenization of corporate debt in the form of bonds, notes and commercial paper | Investors are able to participate with smaller transaction sizes than traditional bond issuance making it very accessible to the broader market. | 177% (2020 vs 2021 Issuance) |

Tokenization creates a common platform for both traditional assets and digital-native assets to interact with each other. This next phase in the evolution of digitization will fuel liquidity and access by opening the markets to a larger base of investors, driving down average transaction sizes and increasing the number of transactions resulting in higher velocity markets, more liquidity, and higher volumes.

While digitization has enabled efficiencies on the execution side, tokenization extends these efficiencies into the custody and settlement layer with the ability to secure, verify and settle the asset and leverage smart contract capabilities for token governance which could include handling corporate actions, and ensuring legal and regulatory requirements over the transaction are met through the use of blockchain oracles which are third-party services allowing real world data to be incorporated into smart contracts.

The implications to financial services firms and those seeking access to the capital markets are broad and deep.

- Issuers will need to obtain new blockchain technologies to deliver the variety of traditional assets onto digital asset venues and exchanges.

- Secondary markets could create new venues to allow greater access to capital markets through centralized or decentralized exchanges and applications and include both small and large company participation.

- Custodians will have to evaluate their role in the safekeeping of assets given the immutability of decentralized ledgers and secure wallets, which allow for the option of direct custody (technological solutions that allow participants to directly store the asset) .

- Fund administrators could benefit by offering real-time administration of tokenized assets (by connecting to settlement and transfer platforms) and lower overall cost to their clients.

- Credit rating agencies will be able to program credit-related information into smart contracts in order to reduce risk in securitized products through enhanced data reliability, access real-time performance data on underlying collateral pools, and improve surveillance.

- Investor rights could be enhanced by enabling automated communication and building in voting capabilities to smart contracts.

- Reducing cost will make smaller deal sizes more economic, increase the potential volume of deals, and give smaller companies access to capital markets.

- More transparency and greater access to on-chain and off-chain data will provide more inputs into financial modeling, creating more robust programs as machine learning and artificial intelligence continue to evolve in parallel.

Tokenization Use Cases Already Impacting our World

We have seen active tokenization use cases across multiple asset classes, such as commodities, debt securities, equity securities, and real estate. Their place in the digital asset marketplace has grown to a size that has not gone unnoticed by investors both retail and institutional alike. Some examples of these tokenization use cases and their benefits are highlighted below.

Commodities: Paxos PAX Gold Digital Token (PAXG)

Benefit: Lower transaction fees and size requirement

Physical gold held by exchange traded funds (ETFs) is over $207 billion as of August 2021 (according to the World Gold Council), with one of the largest funds being the SPDR® Gold Shares (GLD) with a market capitalization of $59 billion.

PAX Gold (PAXG) is an asset-backed digital token approved and regulated by the New York State Department of Financial Services with a total market capitalization of $327 million. The token has seen a steady increase in market capitalization since its issuance date in September 2019. On average, PAXG daily trading volume has been approximately 4.8% of market capitalization while GLD daily trading volume has been approximately 2.5%. The higher trading volume demonstrates the attractiveness of tokenizing gold where Paxos has been able to remove custody fees and decrease the minimum purchase amount, as well as offer instant settlement of tokens to investors.

PAX Gold is an ERC-20 token on the Ethereum blockchain and as an Ethereum smart contract that follows a standard protocol for representing custom tokens. The contract contains basic token characteristics (name, symbol, decimal precision), tracks the total number of tokens, tracks a token balance for each Ethereum address, and permits address owners to transfer portions of their balance to other addresses. As a collateralized stablecoin, PAXG requires the purchase of physical gold to back the issuance of new tokens, and would be limited to Paxos’ ability to maintain its supply of gold to meet demand for PAXG.

Exhibit 3. Tokenized Gold versus Gold ETFs

Exhibit 4. Tokenized Gold versus Gold ETFs

Debt Securities: DBS Bank Singapore Dollar $15 Million Tokenized Bond

| PAX GOLD | Major Gold ETFs | |

|---|---|---|

| Custody Fee | No Fee | 19-40 bps per annum |

| Minimum Purchase | 0.01 t oz ~ $17 | 1 share ($170 as of Aug 2021) |

| Time to Settle | Instant | 1+2 days |

| Allocated | Yes | Variable |

| Instantly Redeemable for Physical | Yes | No |

| Regulated | NYDFS | SEC and equivalents |

| Regulated | Yes depending on Exchange | Yes depending on Exchange |

Source: Paxos and other sources

Debt Securities: DBS Bank Singapore Dollar $15 Million Tokenized Bond

Benefit: Lower size requirement and increased market participation

Singapore corporate debt markets issued SGD $233 billion in 2019. DBS Bank (DBS) issues debt in various currencies; for example, the March 2021 subordinated debt issuance for U.S. Dollars denominated $500 million. DBS also holds 34% market share in the Singapore Dollar (SGD) debt market, issuing SGD$ 5.85 billion in 2019 – and in the Asia ex Japan markets, issuing USD $9 billion according to the bank’s 2020 annual report.

DBS issued its first tokenized bond of SGD $15 million in 2021, which was fully subscribed through the DBS FIX Marketplace. In August 2021, Keppel Corporation issued the first tranche of SGD $50 million commercial paper as part of a US $1 billion digital Euro-commercial paper programme. Investors are able to participate with a minimum ticket size of $10,000 versus $250,000 for a traditional bond issuance, making it very accessible to the broader market.

DBS FIX Marketplace is a fully digital and automated fixed income execution platform. DBS engaged Nivaura to build upon their Aurora platform that provides workflow digitisation and automation technology and enables origination and syndication of f ixed income products. Further, the platform manages legal, operational and sales related transactional data flows and documentation.

Tokenized debt issuances, primarily in Asian and European financial institutions, have started to attract corporate attention given their issued size and tenor.

Exhibit 5. Recent Tokenized Debt

| Issuer | Banque de France | UnionBank | Vonovia | European Investment Bank | Societe General | Keppel |

|---|---|---|---|---|---|---|

| Issuance | Covered bond | 3-yr & 5.25-yr bond | 3-yr bond | 2-yr bond | Medium term note | 3-mth commercial paper |

| Amount | EUR 40 M | PHP 9 B | EUR 20 M | EUR 100 M | EUR 5 M | SGD $50 M |

| Date | May 2020 | Dec 2020 | Jan 2021 | Apr 2021 | Apr 2021 | Aug 2021 |

| Blockchain | Tezos Public | Private | Stellar | Ethereum Public | Tezos Public | Private |

| Industry | Financial | Financial | Real State | Financial | Financial | Financial |

| Region | Europe | Asia | Europe | Europe | Europe | Asia |

Equity Securities: Overstock.com STO (Digital Dividend Token)

Benefit: Automation of corporate actions and capital market access

Listing requirements for NASDAQ and NYSE include company market value ranges between $45-100 million. One of the largest security token offerings (STO) has been Overstock. com, a tech-driven online retailer, with current STO market capitalization of $275 million. Issued in April 2020 using the Tezos blockchain based on the ERC-20 token standard, these preferred shares receive cash distributions via dividends. The market capitalization of the S&P 500 is $37.2 trillion, to which tokenization provides an opportunity to list certain classes of shares for specific purposes on alternative venues. This allows them to take advantage of the benefits that tokenization brings to the market, including automated corporate actions which lower administration costs, fractionalization that increases liquidity, and the security of the immutable record on the ledger.

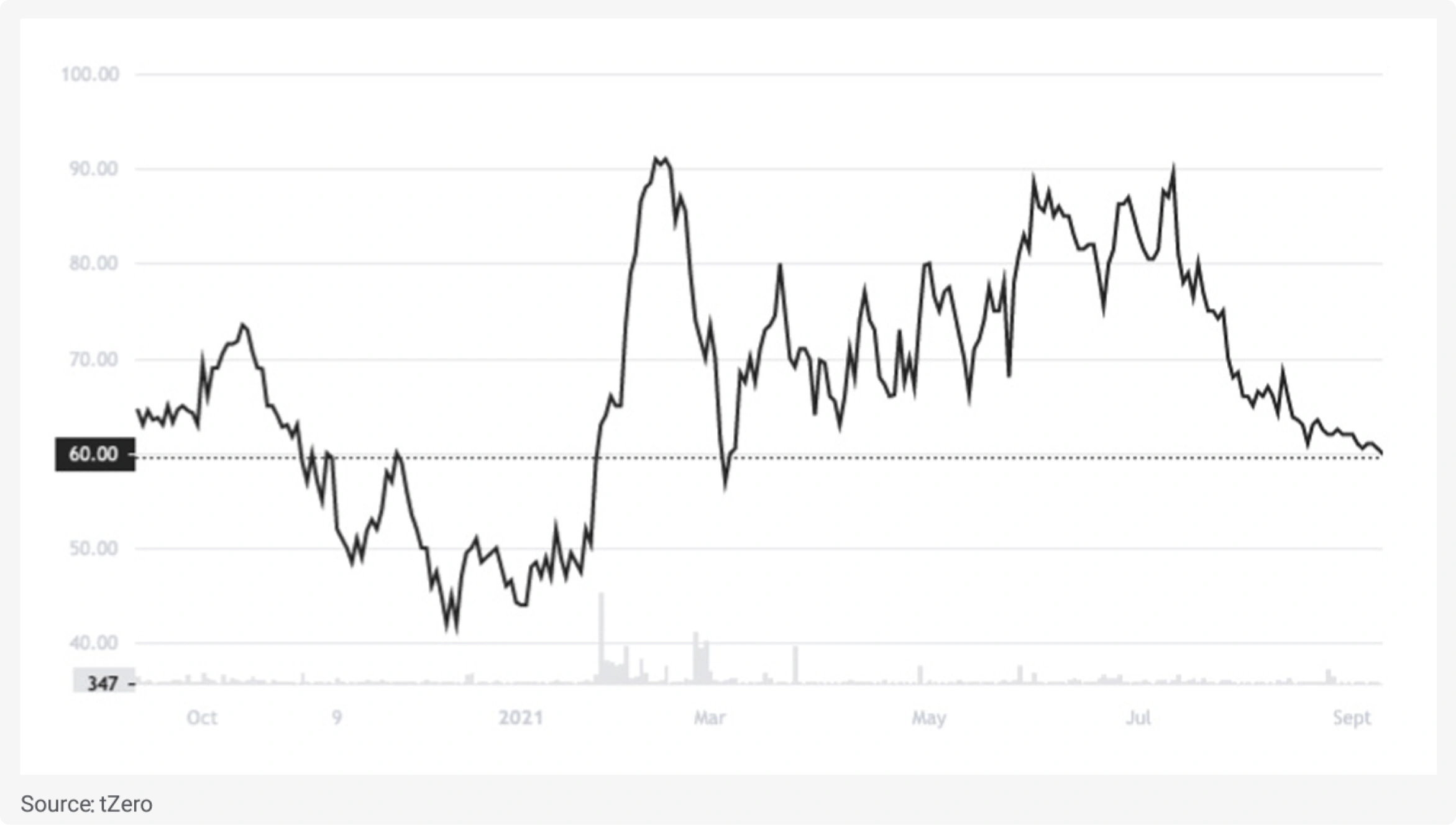

Secondary market trading access is evolving, with security token trading platform tZERO having signed agreements with three companies to provide continuous access to secondary liquidity – OmniValley, an online network connecting startup investors; Trellis, provides alternative-asset liquidity through lending and secondary-market trading services; and Wunderfund, a crowdfunding platform for venture capital.

INX Securities is a registered broker-dealer and member FINRA/SIPC allows access to alternative investment opportunities to both accredited and unaccredited investors, with some assets only available to accredited investors. It lists the only Security Exchange Commission (SEC) U.S. Registered Security, the INX Token, and also allows secondary trading of hedge fund token, Protos Asset Management (PRTS), and three venture capital fund tokens Blockchain Capital (BCAP), Science Blockchain (SCI2) and SpiCE VC (SPICE) on their platform.

ADDX has a Capital Markets Services licence regulated under the Monetary Authority of Singapore and originates funds related to private equity and hedge funds, issuing digital tokens using the ERC-20 standard, and in the case of Percent, a U.S. blockchain based investment platform, has originated private funds and private debt with a total value of US$379 million through the use of tokens.

Exhibit 6. Overstock.com STO (OSTKO)

At this early stage, tokenized equity securities are finding use case opportunities in the private equity, venture capital and hedge fund arenas, providing investors the ability to obtain a transparent and efficient settlement and transfer layer to administer deal transactions. While the size of security token offerings minted at the initial offering stage are small compared to traditional listing venues, they have been used to handle specific use cases for certain classes of shares and have begun to prove their value to issuers and interested investors.

The challenges for the tokenization of equities is the application of existing regulation to include the digitized version of existing securities, the provision of access to the new technology layer for market participants throughout the entire system, and the processes involved in allowing access to the mass market in a safe manner with the appropriate level of regulatory oversight.

Opportunities for Tokenization Technology

Tokenization: The Bridge Between CeFi and DeFi

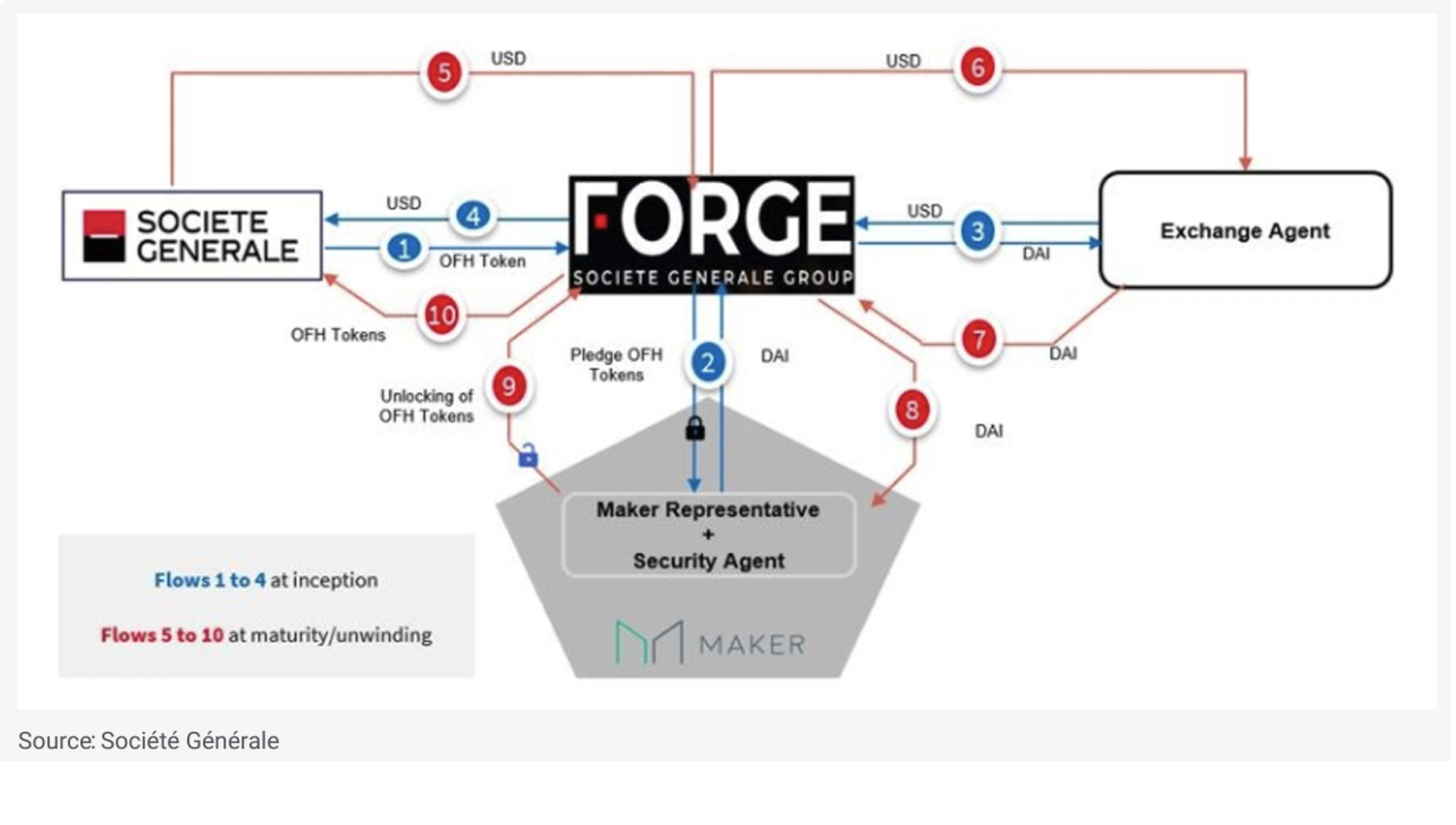

One of the compelling reasons for tokenization is the ability it brings to allow illiquid assets to be used in new ways, such as serving as collateral within the direct lending and decentralized finance (DeFi) markets. The most recent example of this is from Société Générale and MakerDAO, where the French bank will use a tokenized 2020 Euro 40 million bond issuance (OFH tokens) to be transferred on-chain to the DeFi protocol as collateral against their borrowings of 20 million DAI tokens, the stablecoin native to the MakerDAO ecosystem.

Exhibit 7. Société Générale and MakerDAO Loan Flows

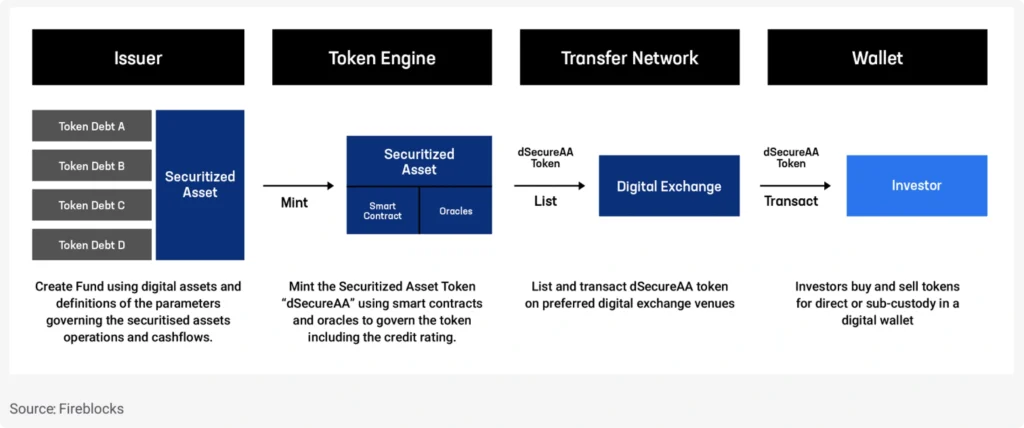

Exhibit 8. Securitization of Tokenized Debt

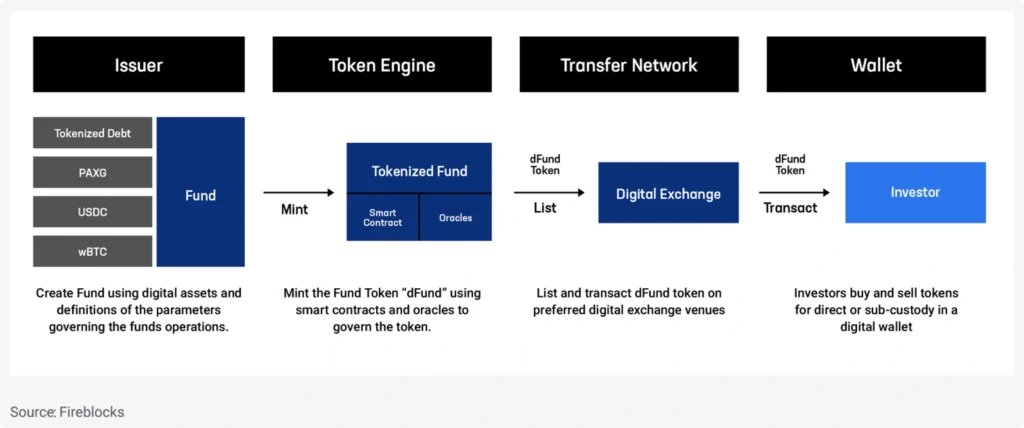

Turning to asset and fund managers, tokenized assets and natively digital assets could also be combined to create tokenized funds which could include programming into the smart contract the necessary financial and non-financial parameters governing the fund.

Exhibit 9. Issuing a Fund Token Consisting of Digital Assets

The construction and delivery of these tokenized asset combinations open up more opportunities to provide safe, stable, high-quality investments to investors in a familiar regulatory environment which will need to be adapted to include a broader range of digital assets.

Tokenization Technology Adoption

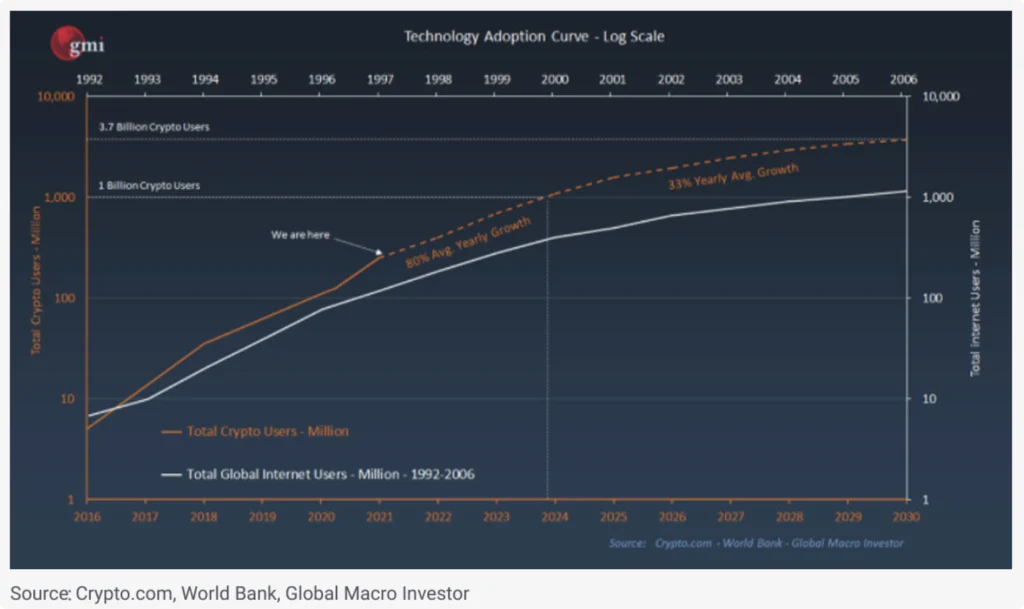

From a technology adoption perspective, over the past five years we have seen the adoption of blockchain and cryptocurrencies mirror the adoption of the internet through the early 90s, and are already seeing real world tokenization use cases leveraging this emerging technology into traditional markets.

Tokenization provides the opportunity to build a robust and scalable infrastructure to support a transparent and well governed digital asset ecosystem from which interested participants are able to access capital markets regardless of size. Financial institutions and service providers will need to carefully consider the blockchain technologies they will need to acquire to integrate or replace existing financial technology infrastructure in order for them to operate in the digital financial markets based on blockchain technology.

Exhibit 10. Technology Adoption Curve

Key Considerations for Tokenization

As the adoption of blockchain technology expands into traditional financial institutions, the use cases for tokenization will expand. While regulatory guidance and frameworks are being put in place for digital-native assets, financial institutions with existing licenses in traditional markets will be able to extend their support for tokenized assets and offer them to their clients. Use cases continue to evolve and there are various opportunities; below are some key considerations for participants across these markets from issuers to broker-dealers to investors to note.

Blockchain Protocols and Interoperability

The first decision to make when tokenizing an asset is the blockchain protocol that the asset will be issued on. Today, the primary blockchain protocol being used for tokenization is Ethereum, which has accounted for 86.7% of issued tokens. Other protocols that support tokenization and smart contracts include Stellar (XLM), Binance Smart Chain (BSC), Tezos (XTZ), and Bitcoin SV (BSV). As tokenization use cases occur across multiple blockchain protocols, interoperability becomes an important topic for issuers.

An example of tokenization across multiple protocols, to be able to leverage specific benefits of each, is the collateral-backed stablecoin, USD Coin (USDC):

- Ethereum: Leading protocol for decentralized finance applications.

- Algorand: Enables enterprise scale applications.

- Solana: Provides scalability and settlement finality with increased adoption by DeFi projects.

- Stellar: Seeks optimization for payments use cases.

- Tron: Maintains a deep ecosystem of support for stablecoins.

| Blockchain | Ethereum | Algorand | Solana | Stellar | Tron |

|---|---|---|---|---|---|

| USDC Supply | 26,651,844,988 | 196,186,441 | 2,485,000,020 | 11,506,752 | 206,974,817 |

| Transaction Speed (TPS) | 20 TPS | 1,000 TPS | 29,000 TPS | 1,000 TPS | 2,000 TPS |

| Transaction Time | 6 min | 45 sec | 3 sec | 4 sec | 5 min |

Smart Contract Standardization

As previously discussed, the standardization of smart contracts to programmatically enforce all actions in the life cycle of an asset will be the key requirement to unlocking the utility of blockchain for traditional markets. The complexities that are being addressed will include the ability of a smart contract protocol to include programmable elements specific to the product being tokenized, which may include unique corporate actions, elements related to environmental, social, and corporate governance (ESG), or specific jurisdictional requirements. Tokenization of traditional assets will involve a collective effort to identify common elements or factors to program into smart contracts for the multiple types of assets and the governance around them.

Legal and Regulatory

Going hand in hand with smart contracts is the adoption of legal and regulatory adoption of these standards. The tokenization of the financial markets will be uneven given the different legal frameworks and structures across the asset classes. Differences between the corporate and financial regulations across jurisdictions bring complexity for digital asset and tokenization use cases. However, as we have seen with the global tax reform initiatives undertaken by G-7 countries to align tax expectations from multinational corporations (2021), it would be reasonable to expect a similar approach to be enacted with financial regulations around digital assets.

Post-Issuance and Secondary Markets

Once tokens are issued, participants are able to purchase these tokens through both centralized and decentralized exchanges, and transfer them to wherever they wish to custody (i.e. a financial institution such as an exchange or bank, or through direct non-custodial wallets). Exchanges that provide primary and secondary market access will still be providing the same services as traditional participants today, and will ultimately fall under the same or similar legal and regulatory requirements.

In the example of Overstock.com, tZero is an SEC and FINRA regulated institution, which is a requirement for being a securities issuer and broker dealer in the United States. In Europe, Switzerland’s Swiss Stock Exchange (SIX) has received two licences from Financial Market Supervisory Authority to operate a stock exchange and depository for blockchain-based securities through its newly formed SIX Digital Exchange and sets the scene for companies to list using security tokens.

Lending and Collateral

As the tokenization of traditional assets scales, the ability to securely and efficiently exchange assets between two parties has the potential to impact additional markets including borrowing and lending. The concept of direct custody and settlement over a blockchain can enable two parties to exchange value in many different forms through tokenization, allowing for financial institutions and corporations to leverage non-traditional assets on their balance sheets as collateral. Through the use of smart contracts, direct peer to peer lending markets have the potential to operate more efficiently and with more trust.

Tokenized assets also have applications and use cases for borrowing and lending through decentralized venues and decentralized finance (DeFi) applications. DeFi can enable market making and swaps across asset classes, and to increase yield, tokenized assets could participate in auto market marking and liquidity pools.

Concluding Thoughts

As the digital-native asset market continues to grow, there will be increasing pressure on traditional financial institutions to provide products and services to meet the changing demands of their customer base. While many of these institutions may not be ready to support products and services for digital-native assets such as Bitcoin and Ethereum, the tokenization of traditional assets will provide a great opportunity to integrate wallet and blockchain technology into their existing infrastructure.

Enabling this integration will future-proof the infrastructure for traditional financial institutions as digital-native markets expand and traditional markets migrate to more efficient, transparent, and lower total cost of ownership technologies. Over the past five years, we have seen the adoption of blockchain and cryptocurrencies mirror the adoption of the internet through the early 90s, and as explored above, we are already seeing real world tokenization use cases leveraging this emerging technology extend into traditional markets.