The financial infrastructure as we know it is undergoing a massive shift due to the introduction of blockchain technology. Payments and financial market players are increasingly integrating blockchain – which has already made an impact in a wide range of industries – into their tech stacks.

Fireblocks and Payments Dive polled over 250 North American payment services providers (PSPs), banks, and merchants to gauge their readiness to adopt blockchain-based payments.

This article will review why so many PSPs and banks are looking to adopt blockchain-based payments, as well as the obstacles they are encountering on their way to doing so.

ABOUT THE SURVEY

A total of 257 North American institutions were polled between December 15th, 2022 and January 15th, 2023. The responses were broken down into the following categories:

Much of the current payment system was built in the 1970s and has yet to catch up with the speed, volume, and breadth of today’s international trade. As a result, the international payments system is slower and more opaque than other parts of digital finance. Payment service providers are seeing this space as ripe for disruption.

The State of Blockchain in the Payments Space

Blockchain represents a new set of payment rails for the industry, much like FedWire or SEPA, in which a transfer of value from one party to another is made and settled easily, and nearly instantly. Over the past few years, the technology has been battle-tested at scale across many different industries, including highly regulated ones such as financial services and healthcare, and has successfully found real-world applications. Payments services appears to be the next area ripe for blockchain-based disruption.

Some providers in the space are further ahead in this area than others. Visa, Stripe, Worldpay, Checkout.com, and National Australia Bank are examples of major players who have embraced blockchain earnestly, exploring and launching a range of new products and services for merchants.

In general, the results of our survey were encouraging:

80%

of respondent banks and PSPs said they have a production-ready system or a POC underway for digital asset payments.

70%

of all merchant servicing respondents also attest to considering stablecoins as a form of payment.

However, a lack of regulatory clarity continues to hold PSPs and banks back, with 48% citing this issue as their main reason for not entering the space.

Upgrading Technology to Meet Merchant Demands

So, where can blockchain make an impact within the payment space?

It’s important to understand that the current state of the market for PSPs is a difficult one. Margins have been compressed as niche players enter the space and unbundle specific parts of the value chain. On the other hand, new market segments are starting to pop up, and merchants are struggling to attract the younger demographic.

To combat this, PSPs are looking to either grow revenue by accessing new market segments and creating new products and services, or by lowering costs and improving the predictability of fund flows. This is why blockchain-based payments are becoming compelling for PSPs.

According the the survey findings:

44%

of PSPs and banks want to use digital asset payments to attract new customers

25%

of PSPs and banks would use it to increase wallet share with existing customers

To enable these new use cases, PSPs and banks must adopt blockchain-based payments as part of their core technology stack today. But what new products and services can PSPs provide with this technology?

In a world where payments between friends or value are shared across a blockchain instantly, it can be difficult to reconcile why organizations operate with settlement times that can take days to process.

Merchants, banks, and PSPs all agree (over 90% in each category, according to our survey) – that daily settlement efficiencies are highly important to them. Being able to offer merchants new products and services (e.g., blockchain-based ones) that provide a higher degree of transparency for clients is a compelling place to start.

72%

interested in settling with their merchants using stablecoins

71%

interested in enabling crypto as a form of payment

69%

interested in utilizing digital assets for internal cross-border transfers

68%

were interested in enabling payouts in digital assets

What’s Holding Payment Service Providers Back?

Clearly, PSPs are aware that blockchain technology can make a positive impact on their businesses. However, many players in this industry have yet to modernize their tech stacks.

Top Concerns

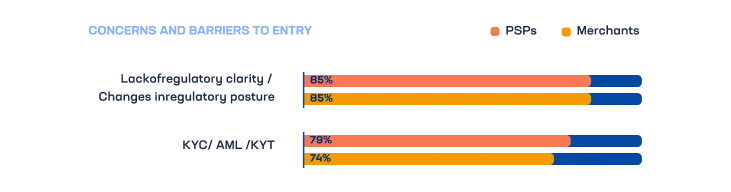

85% of respondents – including both PSPs and merchants – identified a lack of regulatory clarity and potential changes in regulatory posture as large potential concerns when it comes to dealing with digital asset payments. Bank adoption of digital assets and compliance with Know Your Customer (KYC), Anti-Money Laundering (AML), and Know Your Transaction (KYT) requirements were not far behind, at 79% and 74%.

The SEC and CFTC have been particularly aggressive in their enforcement actions, targeting major players in the cryptocurrency industry. These ongoing investigations and allegations have significant implications for the future of digital asset markets, resulting in the stifling of innovation and potentially accelerating the trend of businesses exiting the US market.

There are also concerns amongst industry players that US regulators may push out crypto businesses by creating legal adversity and uncertainty. This creates significant challenges for PSPs and merchants looking to embrace digital asset payments.

Despite these obstacles, the digital asset and cryptocurrency sectors continue to grow and innovate, driven by the belief in the potential of decentralized finance and Web3 technologies. As PSPs and merchants navigate the complex regulatory landscape, it is crucial for regulators to provide clear guidance and a supportive environment to foster responsible innovation and growth in the industry.

Optimism in Digital Assets Prevails Despite Challenges

Despite regulatory challenges and negative events in the crypto markets, optimism persists in the industry, largely due to the growing interest in what digital asset payments can provide for PSPs – an opportunity to drive revenue and improve operational efficiency.

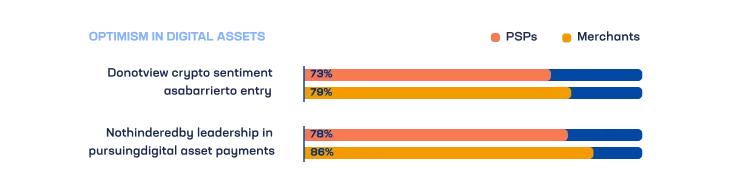

In the face of market downturns during the latter half of 2022, our survey revealed that 73% of PSPs and 79% of merchants do not view crypto sentiment as a barrier to entry. Additionally, only 12% of respondents were uninterested in using any form of digital assets for digital asset payments.

Executive leadership and boards are also optimistic. 78% of PSPs and banks and 86% of merchants say they are not hindered by their leadership in pursuing digital asset payment efforts.

However, the lack of crypto knowledge and expertise remains a significant hurdle for widespread adoption. According to the survey, 41% of PSPs identified this as another top barrier to entry for digital asset payments, with 33% of PSPs citing knowledge and expertise as the most significant barrier to interacting with stablecoins.